July 25, 2024

The banking regulators have not yet gone out on vacation, as demonstrated by this grab-bag of announcements, speeches, rules and guidance:

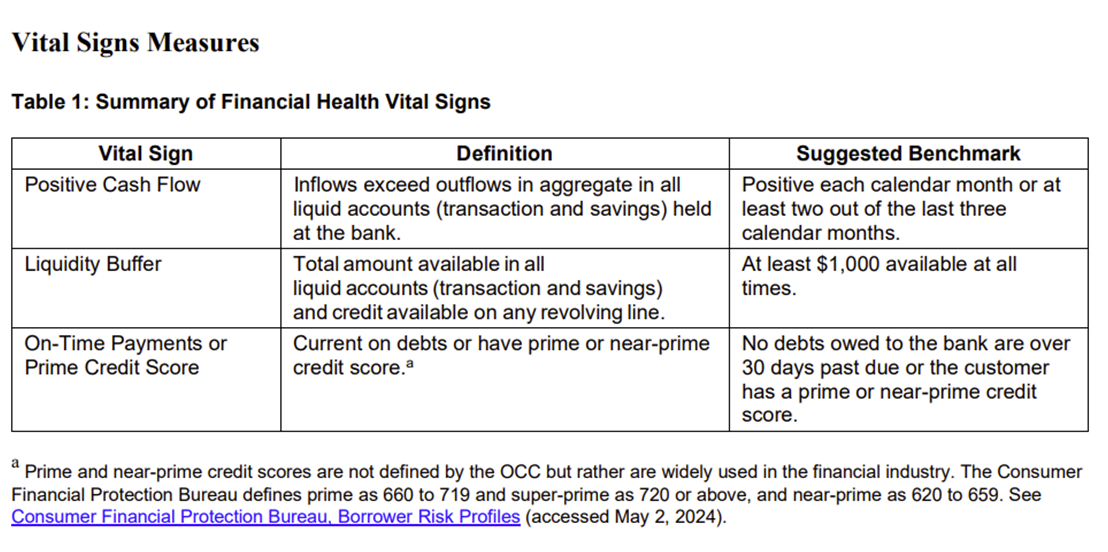

- Acting Comptroller of the Office of the Comptroller of the Currency (OCC), Michael Hsu, gave a speech on July 10th addressing how banks should help customers to avoid fraud, which highlighted a report the OCC put out in June on How Banks Can Measure and Support Customer Financial Health Outcomes. In particular, his speech focuses on the “security” aspect of consumer financial health identified in the report, saying, “Financial institutions can support their customers by providing timely information about trending scams and ways to avoid them. For example, . . . [institutions can] enable frictions such as verifications to help consumers pause before making a payment to an unknown party.” The report on which the speech was based identifies three aspects of consumer financial health – security, stability and resilience, and goes further to suggest to banks “vital signs” that help them understand when a consumer’s financial health may be in peril, see this chart:

The report ends with concrete suggestions regarding steps that banks can take to help consumers improve their financial health any time their vital signs waver, including such things as offering low or no-transaction fee accounts to customers demonstrating cash flow concerns, offering prizes for meeting savings goals for customers with a low liquidity buffer, and offering tools to help customers with lower credit scores to more successfully manage their credit scores.

- Now that the Consumer Financial Protection Bureau (CFPB) has been freed from questions regarding its constitutionality yet again, following the Supreme Court’s decision in Community Financial Services Association of America v. CFPB on May 16th, judicial stays against various rules have been released and the CFPB has begun to move forward with those rules. In particular, the CFPB issued an interim rule extending compliance deadlines for the Small Business Lending Rule implementing Section 1071 of the Consumer Financial Protection Act (CFPA) on June 25th. As the press release accompanying the interim rule states, this means that “[l]enders with the highest volume of small business loans must begin collecting data by July 18, 2025; moderate volume lenders by January 16, 2026; and the smallest volume lenders by October 18, 2026. The deadline for reporting small business lending data to the CFPB remains June 1 following the calendar year for which data are collected. Thus, high volume lenders will first submit data by June 1, 2026, while moderate and low volume lenders will first submit data by June 1, 2027. Under the interim final rule, lenders may continue using their small business originations from 2022 and 2023 to determine their initial compliance date, or instead use their originations from 2023 and 2024.” In other words, the CFPB’s consistent tone deafness regarding the fact that larger institutions are much more likely to struggle with changes in how and when information is collected and reported than smaller institutions continues.

- The CFPB issued its quarterly Supervisory Highlights, which is most useful for financial institutions to understand areas that the CFPB is particularly interested in examining. Among those areas are continued focus upon proper debt collection practices – specifically sending validations of debt to consumers timely and paying attention to requests to stop debt collection communications. Also, the CFPB examined how medical professionals market financial products such as healthcare credit cards to their patients, noting “CFPB examiners will continue to assess financial services companies’ oversight of medical providers and will be monitoring marketing materials and incentives offered to enroll patients.” Finally, the CFPB noted that some big banks and credit unions have begun to waive fees for providing consumers with basic account information, including free balance inquiries at ATMs, which the CFPB says demonstrates compliance with Section 1034 of the CFPA.

- The CFPB issued a proposed so-called “interpretive rule” that will replace a 2020 advisory opinion and explains how existing law applies to paycheck advance products. In particular, “The proposed interpretive rule makes clear that many paycheck advance products – whether provided through employer partnerships or marketed directly to borrowers – trigger obligations under the federal Truth in Lending Act. In addition, the press release the CFPB issued notes that the proposed interpretive rule makes clear that:

- Many loan costs are finance charges: Fees for certain “tips” and expedited delivery meet the Truth in Lending Act’s standard for being finance charges. When the paycheck advance product is no-fee and truly free to the employee, many requirements would not apply.

- Borrowers must receive key disclosures: Among other requirements, earned wage lenders must provide workers with appropriate disclosures about the finance charges. Clear disclosures help borrowers understand and compare loan options, sharpens price competition, and ultimately benefits companies that offer competitive products.”

- On July 24th, the CFPB issued a circular to law enforcement agencies and regulators that explains the CFPB’s position regarding when broad non-disclosure agreements that companies typically have employees sign could be breaking the law by preventing whistleblowing. The circular posits that broad confidentiality agreements violate Section 1057 of the CFPA, which they interpret to mean “provides anti-retaliation protections for covered employees and their representatives who provide information to the CFPB or any other federal, state, or local law enforcement agency regarding potential violations of laws and rules that are subject to the CFPB’s jurisdiction.” The CFPB points to similar concerns of and actions taken by the Securities & Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) on this issue and suggests, “An employer can significantly reduce the risk of . . . violating Section 1057—by ensuring that its agreements expressly permit employees to communicate freely with government enforcement agencies and to cooperate in government investigations.”

- In keeping with the proposed rule updating anti-money laundering (AML) rules published by the Financial Crimes Enforcement Network (FinCEN) of the Department of the Treasury (Treasury), as we reported on in our last issue, four banking regulators including the OCC, the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve, and the National Credit Union Association (NCUA) and in conjunction with FinCEN issued an Interagency Statement Regarding the Issuance of the AML/CFT Program Notices of Proposed Rulemaking on July 18th. The statement is intended to “to highlight how the proposed amendments are intended to complement and build upon current and anticipated AML Act implementation efforts, such as how the proposed amendments would codify into regulation existing risk-based practices and continue to foster the risk-based nature of AML/CFT programs.” The statement is not intended to indicate a new supervisory direction or to unduly impact the final rule, and these agencies, and the banking regulators all recognize that many banks already have AML programs that include the features identified in FinCEN’s proposed rule. Nevertheless, by issuing the statement, the regulators are “communicating their commitment to the AML Act’s purposes of modernizing the AML/CFT regime, encouraging innovation to more effectively counter money laundering and the financing of terrorism, improving law enforcement and national security objectives, and further safeguarding the financial system from illicit activity.”

- On July 17th, Acting Comptroller of the Currency, Michael Hsu addressed the Exchequer Club regarding trends reshaping banking in a speech entitled, “Size, Complexity and Polarization in Banking”. On the first issue – regarding large banks – Hsu states that due to how the banking industry has changed in the last months, “by 2030, large banks as a group are likely to have $20 to $23 trillion in assets, which is roughly the size of the entire U.S. banking system today. This is not a normative view. No matter how one feels about large banks, simple, dispassionate math provides a sense of scale regarding where we’re headed.” To address the challenges large banks present to the economy and the industry, Hsu emphasizes the importance of Basel III, observes that “too big to fail” (TBTF) needs to end and that “too big to manage” (TBTM) needs to effectively curtail how large a bank can get. In particular, Hsu views proportionality, consistency and due process are key in managing the TBTM concerns. On the second issue, regarding the blurring of lines between banks and commerce, Hsu observes that while we have gotten used to having banks and non-banks work together to issue credit, we are now seeing that happen more in the payments space, “customers and merchants are increasingly using fintechs for payments, lending, and deposit services. These fintechs, in turn, partner with banks—sometimes indirectly through intermediaries or other ‘middleware’ firms—to execute on the services offered. Banks, in turn, rely on a host of nonbank service providers such as core processors to support a range of operations and functions. To top it off, banks and nonbanks, like corporations and governments, are increasingly reliant on a handful of large cloud service providers to support their digitalization initiatives.” Pointing to the Bank Services Company Act and interagency guidance on third-party relationships, Hsu comments that these changes in the payment systems mean that “more granular approaches” are necessary and he advocates for tailored federal payments regulation and supervision that will set a higher baseline than state money transmission licenses presently set for fintechs in the payments space. Finally, on the third issue of polarization, Hsu observes that “banks are being asked by states to pick a side in service of performative politics rather than deliberative policy” and he associates this shift with instability and fragmentation in financial services that hampered the United States in its early days before there was a federal banking system in place. The salvation for this issue Hsu finds in rigorous defense of preemption standards by the OCC. To this end he states, “the OCC faces two critical tasks. We must fortify and vigorously defend core preemption, and we must embrace and develop more nuanced analysis when applying Barnett. Fortifying core preemption powers will provide certainty where it matters the most—i.e., with regards to safety and soundness and compliance with federal laws and regulations. Preemption in those areas is legally absolute and non-negotiable, and the OCC will act accordingly to defend that. At the same time, we are reviewing the agency’s 2020 interpretation of preemption under the Dodd-Frank Act to determine whether updates are needed in light of the recent Cantero decision. We need to develop a more nuanced and balanced approach to Barnett. Updating that interpretation could be a helpful step toward that.” (See our discussion of this exact issue in our previous coverage on Cantero.)

On July 24th, the Consumer Financial Protection Bureau (CFPB) issued a new proposed rule “Streamlining Mortgage Servicing for Borrowers Experiencing Payment Difficulties”, with a comment period ending on September 9, 2024. Recognizing that many of the prescriptions put into place in 2013 by the CFPB to address loss mitigation controls, the CFPB is issuing this proposed rule to remove some “prescriptive rules” because “more flexibility is needed in order to respond to future changes in the macroeconomic environment.” And, never fear, while one hand giveth, the other hand taketh away, with the CFPB “proposing certain new procedural safeguards designed to protect borrowers from [servicing] harms while creating strong incentives for servicers to review borrowers for loss mitigation assistance quickly and accurately.”

The rule addresses four areas of servicing. The first proposed change should be welcome to the industry, and involves rolling back the need to conduct simultaneous review of all loss mitigation options available to a borrower, which can occur only after a loss mitigation application is deemed to be “complete.” Instead, the loss mitigation application need not be complete before the servicer determines that certain loss mitigation options will not be applicable or available to the borrower. But, this is where the procedural safeguards come into play, which still should be a better process for the industry than presently – chiefly, the loss mitigation review process “continues until either the borrower’s loan is brought current or one of the following foreclosure procedural safeguards is met: 1) the servicer reviews the borrower for all available loss mitigation options and no available options remain, or 2) the borrower remains unresponsive for a specified period of time despite the servicer regularly taking steps to reach the borrower.” While this means that foreclosure proceedings may not begin until the loss mitigation process is completed, at least now servicers will have a time certain by which they will know that foreclosure processes may begin.

The second area imposes new obligations regarding servicing notices aimed at intervening early in the loss mitigation cycle. So, while the industry will no longer be required to send notices regarding whether a loss mitigation application is complete or incomplete, these new “early intervention” notices will be required.

Additionally, the third area of focus imposes new obligations to send notices regarding “loss mitigation determination notices and appeal rights to borrowers regarding all types of loss mitigation options, instead of just loan modifications, and for offers as well as denials.”

The fourth area addresses “proposing several requirements to provide borrowers with limited English proficiency greater access to certain early intervention and loss mitigation communications in languages other than English” and requiring all notices to be provided in Spanish, as well as in English.

There are some additional points for which the CFPB wants to collect information.

- While the CFPB did not make proposals on this topic, they ask for comment on “possible approaches it could take to ensure mortgage servicers are furnishing accurate and consistent credit reporting information for borrowers undergoing loss mitigation review. In particular . . . (i) What servicer practices may result in the furnishing of inaccurate or inconsistent information about mortgages undergoing loss mitigation review? (ii) What protocols or practices do servicers currently use to ensure that mortgages are being reported accurately and consistently? Are there specific protocols or practices for ensuring loans in forbearance or borrowers affected by a natural disaster are reported accurately and consistently? (iii) Would it be helpful to have a special code that would be used to flag all mortgages undergoing loss mitigation review in tradeline data? [and] (iv) What steps should the CFPB take to ensure servicers furnish accurate and consistent tradeline data?”

- The CFPB requests information on the prevalence of and problems that arise as a result of “zombie mortgage” collection (i.e., when a long-dormant second mortgage is being collected upon).

- Sometimes an effective loss mitigation process includes deferring the overdue amounts to the end of the mortgage, such that those payments become due when the consumer refinances, sells or otherwise terminates their mortgages. The CFPB requests information regarding whether additional notices should be prescribed to remind these borrowers of those deferred amounts being due.

- The CFPB has requested additional information regarding problems affecting “successors in interest” to property such that such consumers are unable to obtain information regarding mortgages from servicers, in an attempt to forestall loss mitigation processes from occurring after the death of the borrower.

Due to some of the changes the CFPB proposes in the rule, certain state laws may conflict, so the CFPB requests comment on whether providing clarity on preemption of some of those laws would be useful.

While we reported in our last Cabinet News & Views on the final rule regarding quality control standards for AVMs which will take effect one year after publication in the Federal Register (i.e., it has not yet been published), the same set of agencies – the banking prudential regulators, CFPB and NCUA – have now issued final interagency guidance addressing Reconsiderations of Value (ROVs) for residential real estate, which is a related, but entirely different topic. The proposed guidance was published last year and included definitions for ROVs and described a prescribed ROV process. The final interagency guidance shifted a bit based upon comments the agencies received, significantly with respect to clarifying the scope of the ROV process requirements and the amount of flexibility financial institutions have in constructing their ROV process to be in compliance with the guidance.

ROVs occur either when the financial institution identifies anomalies in appraisals or AVMs or when “a consumer [provides] specific and verifiable information that may not have been available or considered when the initial valuation and review were performed” of their property. ROVs should be available with respect to residential real estate, which specifically means “real estate-related financial transactions that are secured by a single 1-to-4 family residential property.” The interagency guidance identifies ROVs as being a process that can be used to address a wide variety of concerns and consumer complaints, perhaps most importantly consumer complaints regarding prohibited discrimination in appraisals.

To this end, an effective ROV process will do all of the following:

- Establish standardized processes to increase the consistency of consideration of requests for ROVs;

- Use clear, plain language in notices to consumers of how they may request the ROV;

- Use clear, plain language in ROV policies that provide a consistent process for the consumer, appraiser, and internal stakeholders;

- Establish guidelines for the information the financial institution may need to initiate the ROV process;

- Establish timelines in the complaint or ROV processes for when milestones need to be achieved;

- Establish guidelines for when a second appraisal could be ordered and who assumes the cost; and

- Establish protocols for communicating the status of the complaint or ROV and the lender’s determination to consumers.

Implementation:

The Regulatory Technical Standards (RTS) supplementing Regulation (EU) 2017/2402 (EU Securitisation Regulation) on Principal Adverse Impacts (PAI) of simple, transparent and standardised (STS) securitisations the underlying exposures of which are residential loans or auto loans/leases came into force on 8 July 2024.

The RTS set out content, methodologies and presentation of information on the PAI of assets financed by the underlying exposures for: (a) traditional non-ABCP STS securitisations; and (b) on-balance sheet STS securitisations.

Application:

The RTS are ‘voluntary’, but only insofar as qualifying securitisations must comply either with the RTS or with the provisions set out in Articles 22(4) and 26d(4) of the EU Securitisation Regulation. Originators of STS securitisations with underlying home loan and auto assets will therefore either need to follow the existing requirements of the EU Securitisation Regulation, or the new RTS.

All in-scope originators are covered, including SMEs, new market entrants, financial institutions and large public-interest undertakings.

Why this is happening:

The Sustainable Finance Disclosure Regulation (SFDR) does not apply directly to securitisations, as they are not included within the SFDR definition of a relevant “financial product” (but of course, SFDR does indirectly apply through its entity level disclosure requirements for PAIs to be provided in relation to all investment decisions, including those that relate to securitisations). The EU has determined that, as with SFDR, investors in these particular classes of securitisations should have available consistent information in order to help them complete due diligence for their own ESG purposes. Note that, as with SFDR, the intention is that the RTS does not create either a labelling regime or a methodology of creating ‘sustainable securitisations’.

How does the RTS standardise information?:

Those originators electing to follow the RTS will be required to publish a statement on the PAIs on sustainability factors inherent in the assets financed by the underlying exposures of their transaction via templates appended to the RTS at Tables 1, 2 and 3 of the Annex. These templates track their equivalents set out in SFDR.

Points to note include:

- the information must be made available as required under Article 7(1)(a) of EU SECR, i.e. quarterly;

- while Recital (4) to the RTS allows that originators may use reasonable assumptions and data obtained from obligors or external experts, they should give a detailed explanation of how they used their best efforts to obtain the information;

- Recital (5) requires that when a securitisation repository is required for the prospectus, these RTS disclosures should similarly be lodged with a securitisation repository. In any event, the information must always be in a searchable electronic format;

- Table 1 includes a summary of the PAIs on sustainability factors that cannot exceed two sides of A4;

- Table 2 requires disclosures of additional climate and other environment-related indicators. For residential loans, these should be selected from Annex 1 of Delegated Regulation (EU) 2022/1288 which supplements SFDR Level 1. For auto loans and leases, the indicators to select from focus on emissions. Originators are only obligated to provide the available information on “one or more” additional climate and other environment-related indicator as set out in Table 2;

- Table 3 requires available information on “one or more additional indicators for social and employee matters, respect for human rights, and anti-corruption and anti-bribery matters”;

- if the originator has provided at least one previous statement on PAIs on sustainability factors under this RTS, they must provide a historical comparison going back up to the last four previous periods;

- factual errors should be corrected without undue delay.

Following on from its Primary Markets Effectiveness Review, the UK’s Financial Conduct Authority (FCA) has published feedback to Consultation Paper CP23/31 and its final UK Listing Rules (see here for our note on CP23/31). Policy Statement PS24/6 largely reflects the proposals set out in CP23/31 to enhance investor disclosures, move away from requiring shareholder votes to approve significant and related party transactions, enhance voting structures and create a single and simpler equity listing category known as the Equity Shares in Commercial Companies or ESCC category. Notable changes since CP23/31 include:

- reversion to the previous regime for cash shells and SPACs – these issuers will still have 24 months to complete a transaction but this time limit can be extended by 12 months up to three times with shareholder approval, and for a further six months in certain circumstances;

- there is no longer a requirement for a relationship agreement with a controlling shareholder (a shareholder with at least 30% of the voting power of an issuer), but disclosure of the controlling shareholder is required along with board confirmation of resolutions proposed by controlling shareholders;

- listed companies in financial difficulties are no longer to be required to issue a circular for transactions undertaken to alleviate financial difficulty, but there is a requirement to make an announcement disclosing the nature of the difficulty and what happens if the transaction does not go ahead;

- the new rules on significant and related party transactions will also apply to issuers in the Closed-Ended Investment Fund category.

The new rules and their accompanying transitional provisions take effect from 29 July 2024 at which time the current Listing Rules FCA sourcebook will be replaced in its entirety by a new sourcebook.

The UK’s Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) have published updated Q&A covering changes to the UK European Market Infrastructure Regulation (UK EMIR) reporting requirements that go live on 30 September 2024. Topics covered include:

- Transitional arrangements: From 30 September, all newly entered or modified derivative trades at both trade and position level must comply with the new requirements, but for derivative trades entered into before that date, there is a 6-month transition period for reporting entities to make the necessary updates;

- Reconciliations: This Q&A deals with reconciliations by Trade Repositories (TR) and reporting counterparties and discusses frequency, remediation of reconciliation breaks and two-leg trades, among other topics;

- Errors and omissions: The process for counterparties to approach errors and omissions is given here, including expectations for arrangements that should be in place to identify these;

- Derivative identifiers: Answers here discuss new requirements for the use of Unique Product Identifiers and updated requirements for Unique Transaction Identifiers and Legal Entity Identifiers. Note that the PRA is clear that, despite the updates to UTI requirements, there should be no changes to UTIs for outstanding trades and positions;

- Actions and events: The new requirements introduce a new action type called ‘Revive’ which can be used when a derivative is being re-opened at trade or position level, e.g. from a terminated or errored state;

- Venues: Guidance here discusses how to accurately report the venue where a derivative was executed. Note that it remains the case that derivatives executed on a third country organised trading platform should be reported as OTC unless that trading platform is considered as equivalent to a UK Regulated Market (in which case the derivative should be reported as exchange traded);

- Exchange traded derivatives: These Q&As give guidance on accurate reporting of exchange traded derivatives;

- Margin and collateral: New features include the separation of data on margin and collateral into a new table which now includes fields for post-haircut margin values;

- Clearing: These Q&As give guidance on populating the Clearing Obligation, Cleared and Clearing Member fields of the report;

- Position level reporting: Guidance here discusses how counterparties may report many outstanding derivatives together as a position, subject to certain conditions;

- Asset class and product specific: Topics here include package transactions which comprise transactions not subject to UK EMIR reporting obligations, FX non-deliverable forwards, reporting on derivatives based on cryptoassets and commodity swaps.