Search Results

Following on Mike Mascia’s Closing Remarks delivered to young Fund Finance professionals at last month’s FFA University 1.0, here is some back-to-the-basics advice for those who are just starting their careers in fund finance.

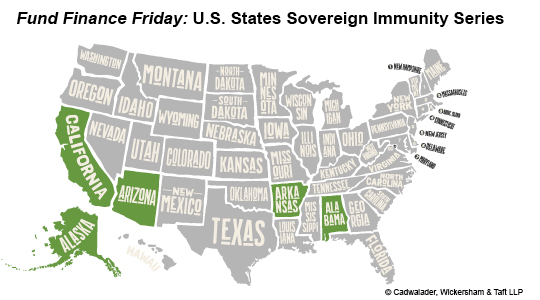

In this week’s Fund Finance Friday, we release the first installment of our Sovereign Immunity Series, a new series in which we examine, in alphabetical order, the sovereign immunity status of each state. Today, we will provide a high-level overview of sovereign immunity in Alabama, Alaska, Arizona, Arkansas and California. Sovereign immunity is a complex legal issue, and one that has been discussed at great length in previous Fund Finance Friday articles.

In case you missed it earlier this summer, here’s our updated guide to primers we’ve previously published in Fund Finance Friday.

New to fund finance or know someone who is? Here’s an updated guide to primers we’ve previously published in Fund Finance Friday.

We have recently been fielding a number of questions from our lender clients on the application of certain investor side letter provisions on the collateral package that secures the repayment of a subscription credit facility. A typical collateral package for subscription credit facilities consists of the fund’s limited partners’ unfunded capital commitments, capital contribution proceeds, and the general partner’s right to call capital from the limited partners. It is common for investors to enter into side letters, which are separate written agreements with the fund which amend, supplement, and alter the terms of the investors’ rights and obligations under its limited partnership agreement with the fund. These changes agreed to by the fund in a side letter may have material implications on a lender’s subscription credit facility. Here we take a look at certain side letter provisions that impact a subscription credit facility, how these provisions operate, and how lenders look to mitigate the risks associated with the consequences of the side letter provisions.

Fund Finance Friday has previously reported on the continuous rise of public pension money in private equity. Generally, such investments are made in commingled funds with a diversified group of investors, but we also commonly see these public pension and retirement funds (each, a “Public Fund”) invest in a fund-of-one vehicle where all or substantially all of the assets are from the Public Fund (a “Fund”). Such Funds are commonly known in the industry as an “SMA” (separately managed account). In this article, I will focus on the recommended scope of due diligence to be conducted when an SMA’s sole investor is a Public Fund to ensure that both the Public Fund has the authority to invest in the SMA (the “Investment”) and to confirm that there is no obvious prohibition of the Investment under state law.

Two recent news items got me thinking about public pensions, their continued rise in private equity and their sovereign status. The first news item, already widely covered in the media, is the announcement by the Securities and Exchange Commission of new rules requiring (among other things) enhanced periodic disclosure for fees, expenses and performance (including, possibly, reporting performance with and without the use of fund financing). The second news item is the increasing deployment of public pension money in private equity as a long-term secular trend.

Between Omicron, the holidays, and down-to-the-wire end-of-year closings, it was a hectic finish to 2021. But now that the calendar reads 2022, we wanted to reflect this week on the state of the NAV finance market and provide some thoughts on trends we're observing as 2022 gets underway.

New to fund finance or know someone who is? Here’s a guide to primers we’ve previously published in Fund Finance Friday.

Even though the market practice has shifted away from obtaining investor letters (“Investor Letters”) for many subscription-based credit facilities (“Facility”), Investor Letters continue to be an effective option to provide additional credit support for certain types of Facilities with single managed accounts and challenging lender provisions in side letters. One of the reasons for this change is that Limited Partnership Agreements (“Partnership Agreements”) have become much more lender-friendly, provide more robust secured Facility provisions, and include many of the important Investor Letter provisions. Investor Letters have historically supplemented the standard loan and security documents and fund formation documents to provide direct assurances from a limited partner (“Fund Investor”) to a lender that the Fund Investor unconditionally stands by its capital commitment to a fund (“Fund”). In this article, we will explore a few of the key provisions contained in Investor Letters and the significance of each to a lender in a subscription facility.