Special Counsel | Fund Finance

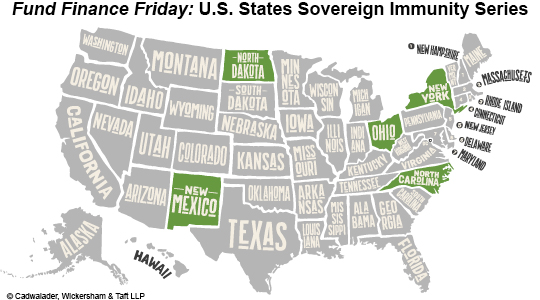

Today we return with our seventh installment in the FFF Sovereign Immunity Series, in which we break down sovereign immunity in New Mexico, New York, North Carolina, North Dakota and Ohio.

For anyone wishing to refresh on what sovereign immunity is, and why we are so concerned about it in fund finance, please refer to the first installment in the series, which provides a helpful overview. All installments to date are copied below, for ease of reference.

- Part I (AL, AK, AR, AZ and CA)

- Part II (CO, CT, DE, FL and GA)

- Part III (HI, ID, IL, IN and IA)

- Part IV (KS, KY, LA, ME and MD)

- Part V (MA, MI, MN, MS and MO)

- Part VI (MT, NE, NV, NH and NJ)

As detailed in previous installments, sovereign immunity is a complex legal issue, and it is important to seek guidance from counsel when considering its implications. The analysis below is a high-level overview only, and it is prudent for lenders and funds to examine each individual state’s statute on a case-by-case basis.

NEW MEXICO

New Mexico has statutorily waived contractual sovereign immunity for actions based on a valid written contract.

It is necessary for the plaintiff suing the New Mexico governmental entity to show that the contract is legally enforceable by showing that a valid contract exists; specifically, the plaintiff must show that there was an offer, acceptance, consideration and mutual assent. Breach of contract claims are barred if they aren’t brought within two years from the time of accrual.

While it is clear that the State of New Mexico has completely waived sovereign immunity when it contractually binds itself to performance, it is worth noting that if the governmental entity curtailed its authority, or acted outside of its designated powers, in entering into the contract, then the contract cannot be enforced as against that entity.

No formal process of collecting a judgment based on contractual liability against the state is set out under statute; however, a similar enforcement procedure, a writ of mandamus, is generally authorized by the New Mexico statutes. Interestingly, punitive damages are not generally recoverable against a governmental entity absent a statute expressly authorizing such an award.

NEW YORK

New York has statutorily waived contractual sovereign immunity by vesting exclusive jurisdiction in the Court of Claims to hear claims brought against the State.

The Court of Claims rules of procedure are outlined by the Uniform Rules for New York State Trial Courts. Thus, a plaintiff enforcing against a New York governmental entity is required to follow these strict rules and to meet all of the required deadlines and notice requirements set out thereunder.

A breach of contract claim must be filed and served upon the attorney general within six months of the claim’s accrual, or at least the service of a notice of intent to file a claim, in which case the claim may be filed within two years of the claim accruing. Orders made by New York’s Court of Claims may be appealed to the appellate division of the supreme court of the department in which the claims arose.

NORTH CAROLINA

North Carolina has waived contractual sovereign immunity.

Under North Carolina law, whenever the State, through its authorized officers and agencies, enters into a valid contract, the State implicitly consents to be sued for damages on the contract if it breaches the contract.

Similar to other states, there must be a valid contract between the parties. If there is no valid contract between the parties, then the State cannot be held to have waived its sovereign immunity for contract claims. If a valid contract has been established, the State and local government, as applicable, are subject to a breach of contract suit in the General Court of Justice.

As with most states, certain exceptions do apply. For example, a waiver will not exist under certain equitable theories such as quantum meruit, which is an equitable remedy that provides restitution for unjust enrichment, if such services or agreements were not authorized by law.

NORTH DAKOTA

North Dakota has waived its sovereign immunity for breach of contract actions.

Article I, § 9 of the North Dakota Constitution provides in part: “Suits may be brought against the state in such manner, in such courts, and in such cases, as the legislative assembly may, by law, direct.” The legislature passed Section 32-12-02 of the North Dakota Century Code, which provides that actions “arising upon contract, may be brought in the district court against the state the same as against a private person.” This statute applies to arms of the State and to implied as well as express contracts.

A fair amount of the case law interpreting this statute focuses on whether the action at issue is in fact one arising upon contract. Thus, as with other states, it’s imperative for the plaintiff to show that a valid contract exists.

Based on statute and case law, North Dakota, as a governmental investor, would be unable to raise sovereign immunity as a defense to a contract claim in a commercial law transaction, provided that all of the necessary elements for contract formation had been met. A right arising under a Subscription Agreement (or other related documentation) isn’t necessarily difficult to characterize and typically clearly creates a contractual right between the parties.

Similar to other states, a plaintiff is required to follow certain steps in order to successfully bring its breach of contract claim against the State of North Dakota. For example, the Supreme Court of North Dakota has strictly construed the relevant section of the North Dakota Century Code that requires the plaintiff to present the claim “to the department, institution, agency, board, or commission to which claim relates for allowance,” by requiring the plaintiff to present its claim in writing and has even dismissed a contract claim because the plaintiff failed to do so. Thus, it is critical for any plaintiff seeking to bring a contract action against the State of North Dakota (as a governmental investor) to present its claim in writing to the relevant department.

OHIO

Contractual sovereign immunity in Ohio has been waived by statute. The Ohio Constitution, article I, section 16, provides that suits may be brought against the State, in such courts and in such manner, as may be provided by law. The General Assembly enacted the Court of Claims Act, which expressly waives sovereign immunity of the State of Ohio, its departments, boards, offices, commissions, agencies, institutions and other instrumentalities, and grants consent to have the liability of such entities determined in a Court of Claims in accordance with the same rules of law applicable to suits between private parties.

CONCLUSION

In the next installment of our FFF Sovereign Immunity Series, we will discuss the sovereign immunity status of Oklahoma, Oregon, Pennsylvania, Rhode Island and South Carolina.