This website uses cookies. By using this website, you agree to our Cookie Policy.

On May 12, 2014, the State Administration of Foreign Exchange (“SAFE”) of the People’s Republic of China (the “PRC”) issued a notice on the Issuance of Administration Rules of Foreign Exchange on Cross-border Security1 (the “Notice”) and promulgated the Administration Rules of Foreign Exchange on Cross-border Security2 (the “Rules”) and the Operational Guidelines for Implementing the Administration Rules of Foreign Exchange on Cross-border Security3(the “Guidelines”, together with the Rules, the “New Rules”), effective on June 1, 2014. Twelve previous regulations or policies (the “Repealed Regulations”) listed in Appendix 3 to the Notice, were repealed when the New Rules took effect.

Summary of Changes. Aimed at reforming the existing regulatory scheme, easing capital control restrictions in the PRC and simplifying administrative and regulatory processes, the New Rules have removed a number of hurdles, redefined the scope of foreign currency regulations and are expected to encourage and assist PRC companies to raise funds outside of China for their overseas transactions and non-PRC companies to use their global assets to facilitate their PRC financing transactions. Future financing transactions will benefit from simpler financing structures, more efficient use of borrowers’ assets and greater legal certainty provided by the New Rules. Some major differences between the New Rules and Repealed Regulations are summarized in the appendix attached to this memorandum. In this memorandum, we use “onshore” to refer to the PRC, and “offshore” to refer to outside of China.

Under the New Rules, documentary requirements and regulatory processes are simplified and restrictions on loans between onshore and offshore entities are loosened.

- SAFE’s approval is no longer required for the provision of cross-border guarantees or security arrangements (for example, collateral).

- Making a payment under a cross-border guarantee or security arrangement is no longer subject to SAFE’s approval.

- Replacing the previous SAFE pre-approval as a condition for a cross-border guarantee or security arrangement, registration with SAFE after entering into a commitment is instead required under specified circumstances. However, registration with SAFE is not a condition precedent for the validity of a cross-border guarantee or security arrangement.

The New Rules are also expected to:

- result in lower funding costs for offshore and onshore debt financing transactions;

- facilitate offshore financing transactions (including bond offerings), stimulate growth of the bond market and provide additional methods of financing for offshore operations of PRC businesses and mergers and acquisitions;

- provide stronger protection for creditors (including bondholders) through guarantees or security arrangements, as compared to currently-existing credit support mechanisms; and

- permit a wider use of assets by offshore entities to assist with onshore financing transactions.

The New Rules have significantly relaxed the requirements on providing cross-border guarantees or security arrangements in offshore financings, which greatly facilitates both commercial lending and bond financing transactions. In a bond offering, offshore investors can now benefit from guarantees or security arrangements provided by the onshore parent of the offshore issuer. In a bank financing transaction, an offshore lender can also benefit (in addition to benefits provided by the onshore parent) from guarantees or security arrangements provided by the onshore subsidiaries or other affiliates of the offshore issuer. The different treatment is primarily due to the requirement that in a bond offering, the onshore guarantor or security provider must directly or indirectly own shares of the offshore issuer. It remains to be seen if this difference will significantly favor offshore commercial lending over offshore debt capital markets transactions.

Categories of Cross-border Guarantees or Security Arrangements. Cross-border guarantees or security arrangements fall into three categories under the New Rules:

(i) guarantees and security arrangements provided by onshore entities of offshore indebtedness (“NBWD” or “内保外贷”),

(ii) guarantees and security arrangements provided by offshore entities of onshore indebtedness (“WBND” or “外保内贷”) and

(iii) other cross-border guarantees and security arrangements.

Each category is briefly discussed below:

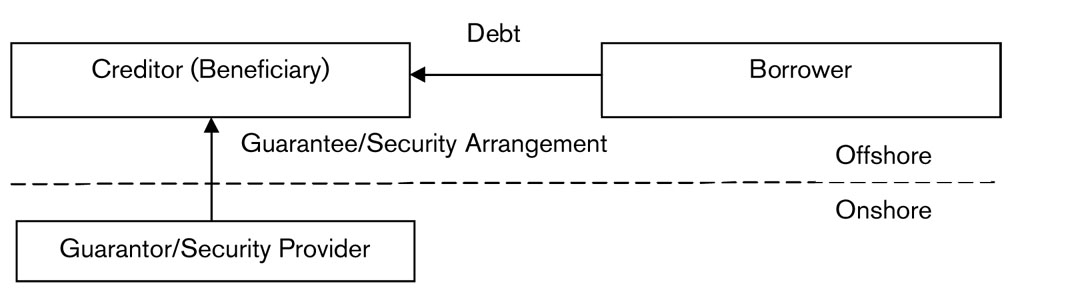

I. NBWD: Guarantees and Security Arrangements Provided by Onshore Entities of Offshore Indebtedness

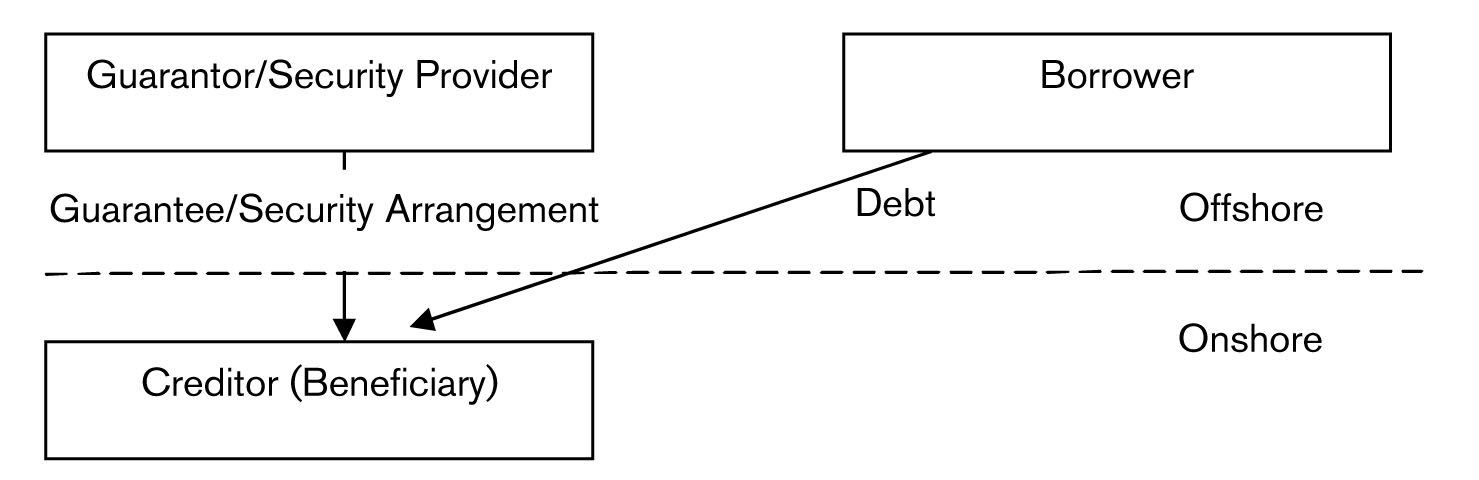

NBWD is a cross-border guarantee or security arrangement provided by an onshore enterprise in respect of an offshore debt incurred by an offshore company. Both the creditor (or the beneficiary) and the borrower are offshore entities. The following chart shows the relationship among the parties:

Summary of Changes. Under the New Rules, onshore companies are allowed to provide guarantees or security arrangements to offshore borrowers without SAFE’s prior approval or registration. When providing a guarantee or security arrangement, an onshore bank guarantor or security provider may complete its registration with SAFE using a data interface program, while an onshore non‑bank guarantor or security provider needs only to complete its registration with a local SAFE bureau within 15 business days after execution of the relevant guarantee or security agreement. Failure to register the guarantee or security arrangement, however, does not affect its validity under the New Rules.

When making a payment under a guarantee or security arrangement, a bank guarantor or security provider can make payments pursuant to the guarantee or security arrangement without SAFE’s approval. For an onshore non-bank guarantor or security provider, it can present the evidence of its SAFE registration to a domestic bank for making cross-border foreign exchange payments and no SAFE approval or verification is required.

The New Rules further remove shareholding and asset requirements of the parties and structural requirements relating to the relationship between the onshore guarantor or security provider and the offshore borrower, except in the case of an offshore bond offering, and abolish the existing quota limitation.

Significance to Debt Financing Transactions. The New Rules are of great significance to offshore debt financings in that:

- A PRC enterprise is now provided with an additional option to assist its offshore affiliates to raise funds offshore.

- A cross-border guarantee or security arrangement in an offshore lending transaction or bond offering can constitute a stronger legal basis for protection of offshore creditors following an event of default given that it provides an additional source of security. Compared with the other credit support mechanisms adopted recently in offshore bond offerings (such as keepwell deeds and equity interest purchase undertakings), there should be fewer legal enforceability issues and regulatory risks associated with a guarantee or security arrangement under the New Rules. A registered guarantee or security arrangement may provide much needed certainty in a debt financing transaction.

- Funding costs are expected to be reduced as a result of enhanced access to the credit of onshore guarantors or security providers.

Restrictions. The New Rules, however, retain certain restrictions for the purpose of controlling the aggregate risk of cross-border guarantees and security arrangements. The remaining major limitations are as follow:

- Offshore funds can be used only in the offshore borrower’s ordinary course of business and cannot be used for any speculative transactions or arbitrage trades.

- The offshore borrower may not repatriate funds borrowed offshore through loans, equity contributions or other securities investments, directly or indirectly, unless such borrower receives SAFE’s approval.

- The offshore borrower may not use such borrowed funds to acquire, directly or indirectly, shares in an offshore target company more than 50% of whose assets are located in the PRC, unless such borrower receives SAFE’s approval.

- The offshore borrower may not use such borrowed funds to repay debts it or other offshore companies incur, if proceeds of such debts have been previously sent, directly or indirectly, onshore, through equity or debt investments, unless such borrower receives SAFE’s approval.

- The offshore borrower may not use such borrowed funds to make a payment for goods or services delivered by a PRC entity more than one year in advance of receipt for such goods or services, if such payment exceeds US$1 million and 30% of the contract value, unless such borrower receives SAFE’s approval.

- For an offshore bond offering, there are additional restrictions: (i) the onshore guarantor or security provider must be a direct or indirect shareholder of the offshore issuer (and not merely a subsidiary or affiliate of such a shareholder); (ii) proceeds of such bond offering must be used in offshore investment projects with which such onshore guarantor or security provider has an ownership relationship; and (iii) such offshore entity or project must have received the required approval, registration, filing or confirmation by the relevant PRC agency in charge of foreign investments, pursuant to relevant rules.

- If a non-bank guarantor or security provider makes payments under its guarantee or security without SAFE’s approval, such non‑bank guarantor or security provider is prohibited from providing new guarantee or security for any offshore indebtedness before it is fully indemnified by the borrower.

- An onshore guarantor or security provider must register with SAFE (i) the guarantee or security arrangement after its execution and (ii) the foreign debt it holds after making a payment under such guarantee or security arrangement.

Other cross-border credit support mechanisms, such as keepwell deeds and equity interest purchase undertakings, do not fall within the scope of cross-border guarantees or security arrangements covered by the New Rules. Thus, such undertakings remain unregulated in the PRC.

Primary Beneficiaries of the New Rules under NBWD. Due to the above restrictions, PRC companies having, or intending to expand, their offshore operations are expected to be the primary beneficiaries of the New Rules, particularly those companies which have PRC parents with strong credit, or which have significant onshore assets (not held in their PRC subsidiaries, from the standpoint of the bond deals). Where these companies are comfortable with the New Rules’ prohibition of fund repatriation to the PRC, they can benefit from the abilities to provide or receive onshore guarantees or security arrangements directly from China for their offshore financings (including bond offerings) without SAFE’s approval. PRC companies with domestically-focused operations, however, are expected to receive significantly lesser benefit from the New Rules, in light of the fact that they typically need to repatriate funds raised offshore into the PRC.

Issues Relating to Ownership Requirement in Offshore Bond Offerings. The New Rules require that the onshore guarantor or security provider be a direct or indirect shareholder of the offshore issuer in an offshore bond offering. This requirement effectively narrows the New Rules’ application to a transaction where the offshore issuer is a subsidiary of the onshore guarantor or security provider. It prevents an onshore subsidiary of the guarantor or the security provider from providing a guarantee or security arrangement where the subsidiary does not directly or indirectly own shares of the offshore issuer. Similarly, where the offshore issuer owns shares in an onshore subsidiary, the subsidiary cannot provide an upstream guarantee or security arrangement. In a transaction where the relevant PRC business utilizes an onshore holding company structure, a NBWD guarantee or security arrangement provided by an onshore guarantor or security provider in an offshore bond offering will thus be structurally subordinated to the indebtedness of its subsidiaries.

Interestingly, this ownership requirement is not imposed on cross-border guarantees or security arrangements provided for other types of debt financing transactions, such as commercial lending. An offshore bank lender can obtain guarantees and security arrangements not only from an onshore guarantor or security provider, but also from its subsidiaries or affiliates. If a guarantee or security arrangement is provided by an onshore subsidiary, such guarantee or security arrangement is not structurally subordinated to such subsidiary’s other indebtedness.

As a result of this distinction, certain types of offshore creditors, such as lenders in loan transactions, will have better access to onshore subsidiaries’ assets than bond investors. The different treatment seems to be rooted in SAFE’s reluctance to relax requirements for transactions involving multiple investors, where investors’ demands and purposes may vary significantly. The effect, whether intended or unintended, is that offshore bond investors will typically remain subordinated not only to domestic creditors, but may also now be similarly subordinated to offshore financial institution creditors.

The scope of application of the New Rules in respect of bond offerings also affects the use of other, unregulated, credit support mechanisms in future bond offerings. Before the New Rules took effect, a cross-border guarantee or security arrangement was required to be approved by SAFE and was subject to various shareholding and net asset restrictions. The stringent application requirements and lengthy time for obtaining approvals presented significant difficulties to many onshore companies. As a result, credit support mechanisms such as keepwell deeds, standby letters of credit and equity interest purchase undertakings have been adopted in offshore debt financing transactions to enhance the credit quality of bonds issued by offshore subsidiaries. Enforceability of some credit support mechanisms, however, has never been tested in the onshore legal system. If the equity ownership requirement in the New Rules proves to provide only limited benefits to offshore bond investors, such mechanisms may continue to be used in future bond offerings.

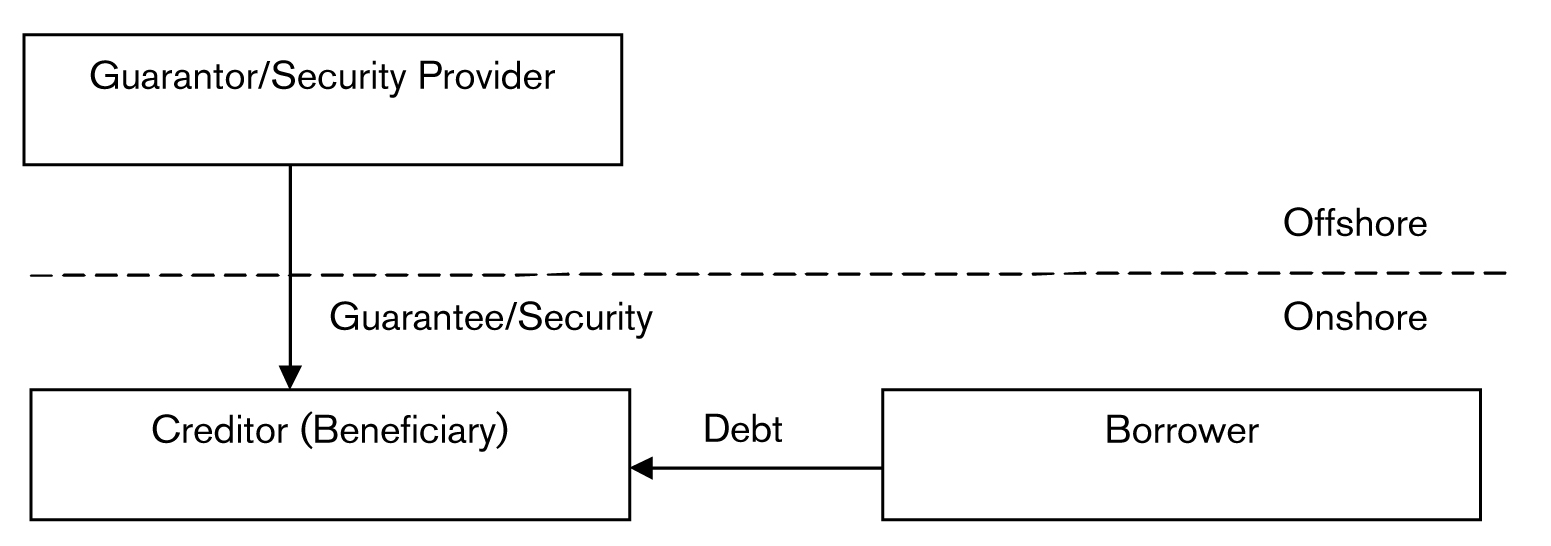

II. WBND: Guarantees and Security Arrangements Provided by Offshore Entities of Onshore Indebtedness

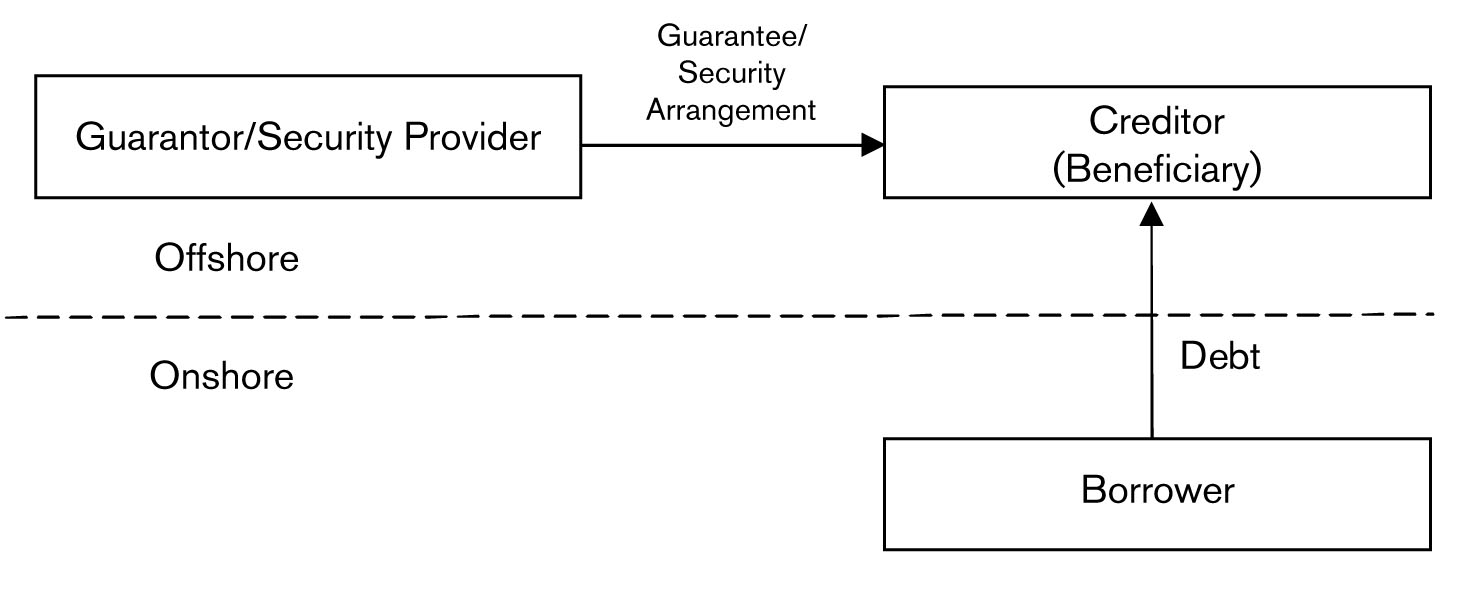

WBND is a cross-border guarantee or security arrangement provided by an offshore entity in respect of an onshore debt incurred by an onshore company. The creditor (or beneficiary) is an onshore financial institution and the borrower is an onshore non-financial institution. The indebtedness must be a binding credit obligation denominated in RMB or a foreign currency. The following diagram illustrates the relationship among the parties:

Summary of Changes. Under the New Rules, no SAFE approval or registration is required for an offshore guarantor or security provider to provide WBND guarantee or security. Further, no SAFE approval is required for the guarantor or security provider to perform its obligations under the guarantee or security arrangement. The borrower, however, must register with SAFE a foreign debt within 15 business days after the guarantor or security provider makes any payment under the guarantee or security arrangement. There are no requirements or restrictions relating to the relationship between the offshore guarantor or security provider and the onshore borrower. Failure to register the guarantee or security arrangement does not affect its validity under the New Rules.

Significance to Debt Financing Transactions. The New Rules are of great significance to onshore debt financing transactions in that:

- A PRC company with a substantial offshore affiliate is provided with more options to finance its projects or operations onshore. The structure constitutes a viable channel for a multinational corporation with limited assets or financing alternatives onshore to finance its expansion or growth in the PRC with its assets offshore.

- With fewer restrictions under the New Rules, an offshore guarantee or security arrangement may also provide a more efficient financing alternative to a PRC domestic enterprise, especially where its offshore affiliate has significant assets overseas.

Restrictions. Certain restrictions are imposed to limit the aggregate scope of offshore guarantees and security arrangements provided to support indebtedness incurred onshore. Some of the major restrictions are as follow:

- If the offshore guarantor or security provider makes a payment under its guarantee or security arrangement, the onshore borrower may not procure any new offshore guarantee or security arrangement or make additional drawdowns from an existing guarantee or security arrangement before it fully indemnifies the offshore guarantor or security provider, without an approval from SAFE.

- If any offshore guarantee or security arrangement has been enforced, the aggregate unpaid principal amount of any foreign debt thereby incurred by the onshore borrower as a result of the enforcement is limited to the amount of the borrower’s net assets (as indicated on the balance sheet of its most recently completed fiscal year) plus, if applicable, its foreign debt quota.

- If the offshore guarantor or security provider makes a payment under its guarantee or security arrangement, the onshore borrower must register with SAFE its foreign debt within 15 business days of such payments.

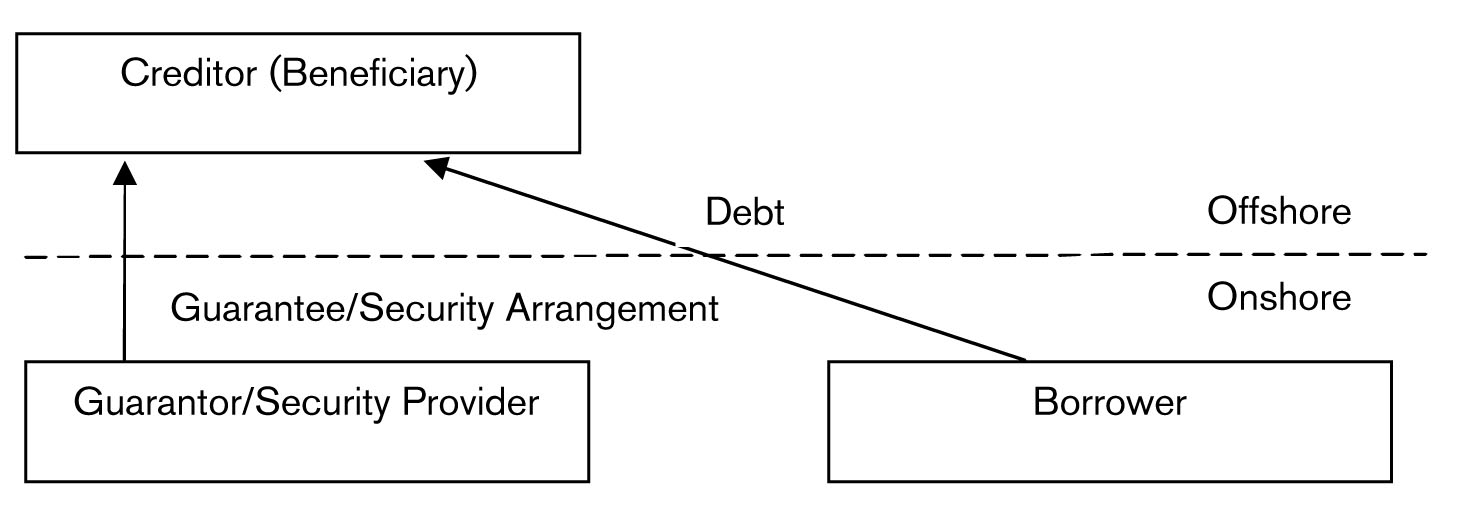

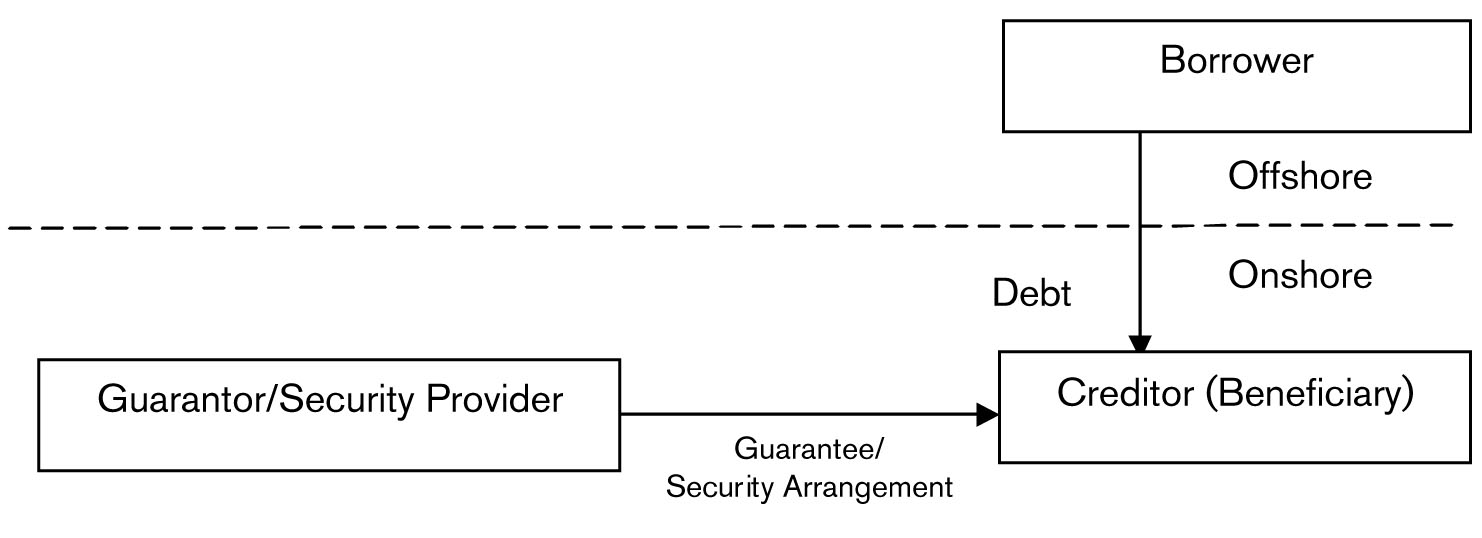

III. Other Cross-border Guarantees or Security Arrangements

Cross-border guarantees or security arrangements not falling into the above two categories are classified as other cross-border guarantees or security arrangements under the New Rules. Such guarantees or security arrangements may include, but are not limited to:

- Guarantee/security arrangement provided by an onshore company to an offshore creditor in connection with a loan that an onshore company borrows from the offshore creditor:

- Guarantee/security arrangement provided by an onshore company to an onshore creditor in connection with a loan that an offshore company borrows from the onshore creditor:

- Guarantee/security arrangement provided by an offshore company to an onshore creditor in connection with a loan that another offshore company borrows from the onshore creditor:

- Guarantee/security arrangement provided by an offshore company to an offshore creditor in connection with a loan that another onshore company borrows from the offshore creditor:

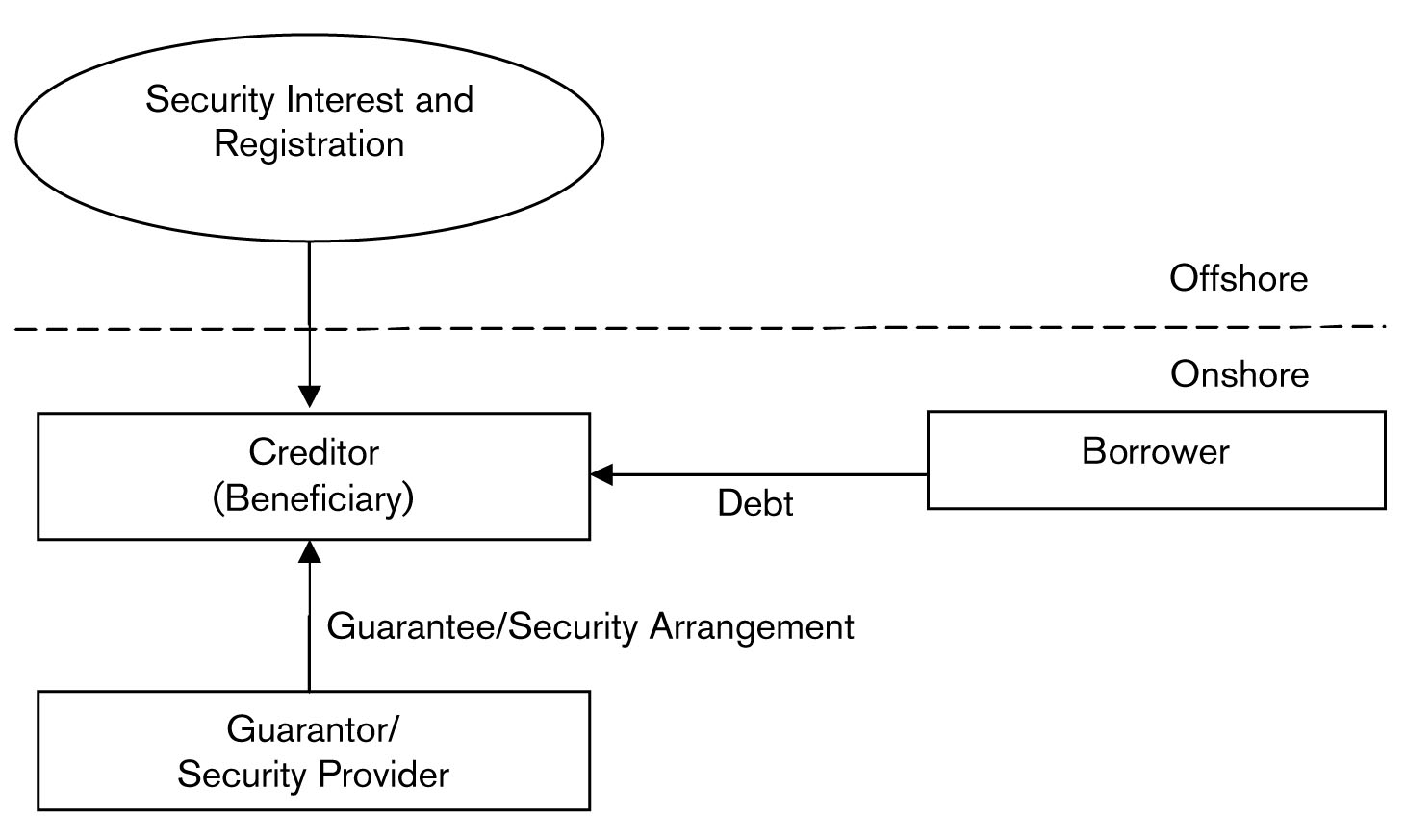

- Security interest is located and registered offshore while the borrower, guarantor or security provider and creditor are located onshore:

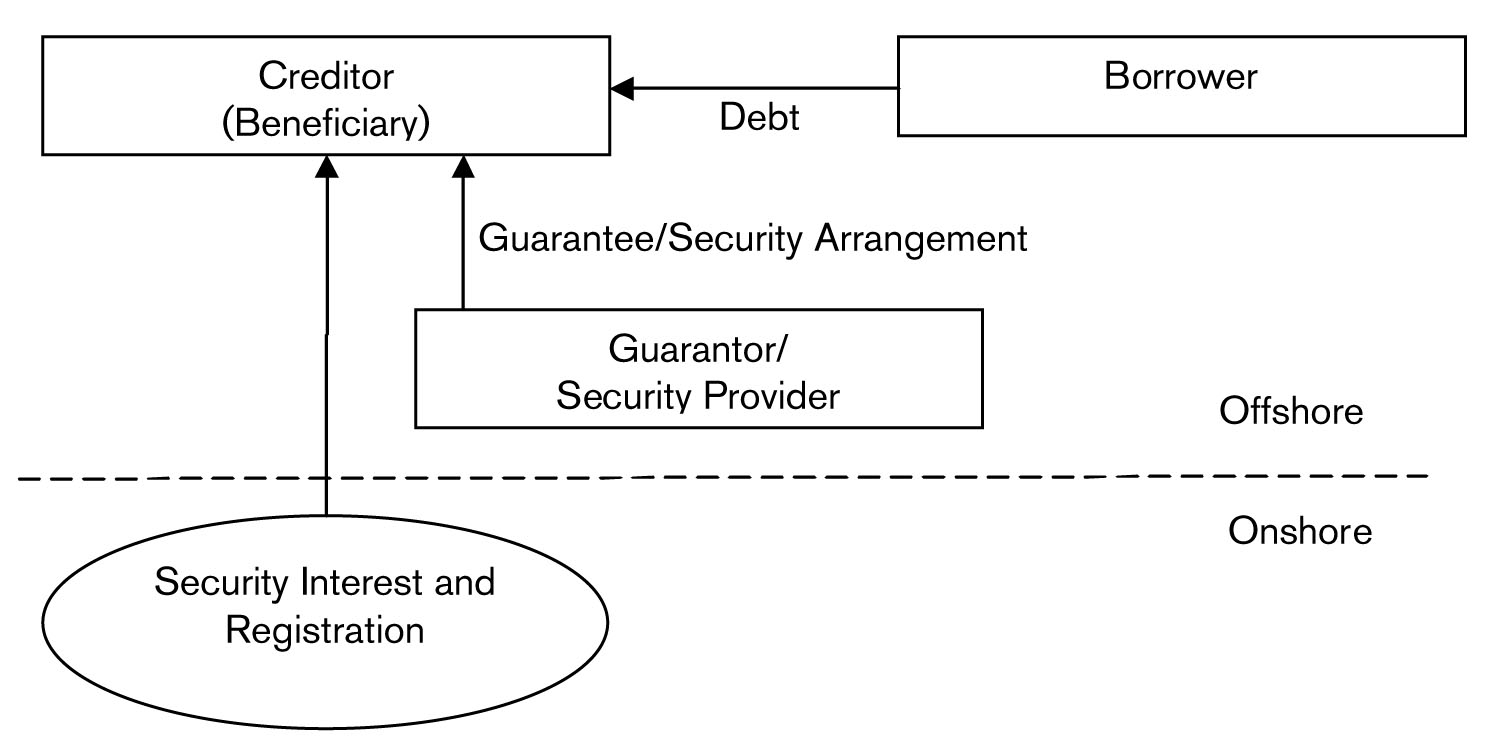

- Security interest is located and registered onshore while the borrower, guarantor or security provider and creditor are located offshore:

Summary of Changes. Under the New Rules, no SAFE approval or registration is generally required in connection with providing cross-border guarantees or security arrangements in this category except where specifically required. There are few restrictions under the New Rules in respect of other cross-border guarantees or security arrangements other than a general requirement of compliance with relevant laws (including SAFE rules). While the requirements on cross-border security are loosened, incurrence of cross-border indebtedness remains subject to applicable existing regulations.

IV. Remaining Issues

Notwithstanding the New Rules, certain existing regulations (the "PBOC Regulations") adopted by the People's Bank of China, such as the Administrative Measures for the Provision of Guarantee to Foreign Parties by Domestic Institutions4, which contain restrictions on PRC companies providing cross-border guarantees or security arrangements, have not been amended. For example, existing PBOC Regulations prohibit PRC companies from providing offshore guarantees or security arrangements unless in proportion to these companies’ equity interests in their invested companies, or unless for their subsidiaries. Further, the PBOC Regulations impose on PRC companies requirements including amounts of offshore security in relation to their net assets and foreign currency revenues, as well as specific net assets versus total assets ratios.

Along with the effectiveness of the New Rules, SAFE abolished the Repealed Regulations, which were intended to supplement, and to provide implementation details of, the PBOC Regulations. In light of the PRC central government’s objective in simplifying the government’s administrative processes, we anticipate that similar amendments will be made in the PBOC Regulations.

V. Conclusion

The New Rules significantly simplify regulatory and administrative processes to make a more efficient debt financing market, which is expected to be helpful for PRC businesses seeking to raise funds offshore. The easing of capital controls is also expected to facilitate debt financing transactions onshore. It remains to be seen, however, how the equity ownership requirement in relation to NBWD’s issuer and its guarantor or security provider will affect offshore bond offerings.

* * * * *

APPENDIX

Major Differences between New Rules and Repealed Regulations

A. NBWD: Guarantees and Security Arrangements Provided by Onshore Entities of Offshore Indebtedness

The following table sets forth some of the major differences between the New Rules and the Repealed Regulations as they relate to onshore guarantees and security arrangements for offshore financings:

|

Restrictions/Requirements |

New Rules |

Repealed Regulations |

|

Validity of a cross-border guarantee or security arrangement |

Validity not subject to SAFE approval or registration |

Validity subject to SAFE approval and registration |

|

Approval and registration |

No SAFE approval needed; and SAFE registration required after execution of the guarantee or security agreement |

Subject to SAFE approval; and SAFE registration within 15 business days after execution of the guarantee or the security agreement |

|

Qualifications of the borrower |

No shareholding or net asset restrictions |

Stringent shareholding and net asset restrictions |

|

Restrictions on the amount of guarantee/security |

No quota restrictions |

Quota restrictions |

|

Relationship between the guarantor or security provider and the borrower |

In a bond offering, the onshore guarantor or security provider must directly or indirectly own shares of the offshore issuer. |

The onshore guarantor or security provider must own shares of the offshore issuer. |

|

Credit enhancement structure |

No verifications or approval requirements except that a non-bank financial institution cannot provide a new guarantee or security arrangement before it is fully indemnified by a borrower if it has made payments on behalf of that borrower under a guarantee or a security arrangement |

Subject to SAFE case-by-case verification and approval for non-bank financial institutions or corporates |

B. WBND: Guarantees and Security Arrangements Provided by Offshore Entities of Onshore Indebtedness

The following table sets forth some of the major differences between the New Rules and the Repealed Regulations as they relate to offshore guarantees and security arrangements for onshore financings:

|

Restrictions/Requirements |

New Rules |

Repealed Regulations |

|

Limit on the amount of indebtedness |

No quota restrictions |

Quota restrictions generally applicable with limited exceptions in some select regions |

|

Registration requirement |

No SAFE approval or registration requirement for providing guarantees or security arrangements |

Onshore financial institutions to fulfill stringent filing requirements |

|

Approval before payments under guarantees or the security arrangements |

No verification or approval requirement |

Substantial filing requirements; and Subject to SAFE verification and approval |

C. Other Cross-border Guarantees and Security Arrangements

The following table sets forth some of the major differences between the New Rules and the Repealed Regulations as they relate to other cross-border guarantees and security arrangements:

|

Restrictions/Requirements |

New Rules |

Repealed Regulations |

|

Validity of a cross-border guarantee or security arrangement |

Validity not subject to SAFE approval or registration |

Invalid without prior SAFE approval or registration after providing security |

|

Approval and registration requirements |

No SAFE approval or registration requirements |

Subject to SAFE approval; and/or SAFE registration requirements |

|

Other restrictions |

Only a general requirement of compliance with relevant SAFE rules and other applicable laws |

A number of restrictions including the qualification of the borrower and the existing relationship between the guarantor or security provider and the borrower |